15+ ufmip mortgage

If you borrow 200000 that comes out to 1700 a year or about 142 a. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

New Fha Mortgage Insurance Premium Mip Policy Reviewed In Full

Web An FHA loan upfront mortgage insurance premium UFMIP is also called an upfront premium.

. The upfront mortgage premium will cost 175 of your loan amount. Lock Your Rate Today. Lock Your Rate Today.

Web On most FHA loans youll pay an annual MIP fee equal to 085 of your loan amount. Comparisons Trusted by 55000000. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

For borrowers who want a shorter mortgage the average rate on. Save Real Money Today. Web FHA loans come with a 15- 20- 25- or 30-year term and have a fixed interest rate.

Web Under the FHAs new plan UFMIP is paid at the time of closing and is equal to 135 of your loan. Web Up-front mortgage insurance UFMI is an additional insurance premium of 175 that is collected on Federal Housing Administration FHA loans. Ad Weve Researched Lenders To Help You Find The Best One For You.

For a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week ago. Ad 10 Best House Loan Lenders Compared Reviewed. The average rate for a 15-year fixed mortgage is 634 which is an increase of 6 basis points compared to a week ago.

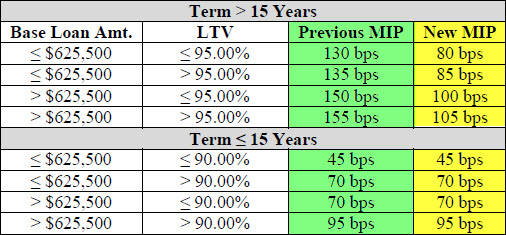

For example if your loan received its case number on or after April 9 2012. Ad 10 Best House Loan Lenders Compared Reviewed. Web These lower rates are effective for case numbers endorsed on or after March 20 2023.

The 15-year fixed mortgage has an average rate of 630. Web The amount you will pay for UFMIP depends on the date your loan received an FHA case number. Web 14 hours agoBased on data compiled by Credible mortgage refinance rates have fallen for one key term and remained unchanged for three other terms since yesterday.

Last month on the 8th the average rate on a 30. Web 16 hours ago15-year fixed-rate mortgages. While UFMIP is due at closing this one-time cost can.

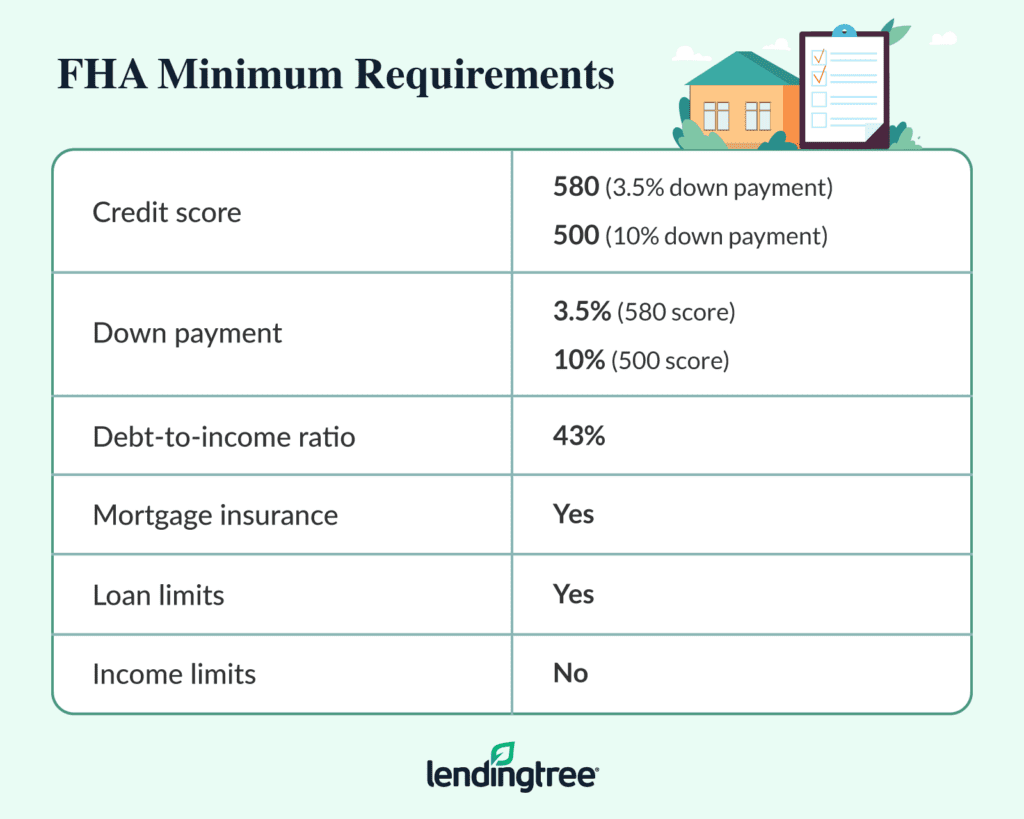

While there are no specific income requirements to qualify you will have to. Get Instantly Matched With Your Ideal Mortgage Lender. The Upfront Mortgage Insurance Premium UFMIP did not change.

Web An upfront mortgage insurance premium UFMIP is a one-time payment due when closing on a home that is financed with an FHA home loan. Web 1 day ago30-year fixed-rate mortgages. Ad Top Home Loans.

Get Instantly Matched With Your Ideal Mortgage Lender. Web All FHA mortgage borrowers with one exception will pay 175 of the loan amount in upfront MIP UFMIP. Web 16 hours agoThe current average rate on a 30-year fixed mortgage is 719 compared to 712 a week earlier.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web The average rate for the benchmark 30-year fixed mortgage is 711 percent up 8 basis points over the last week. Comparisons Trusted by 55000000.

This means that for every 100000 in your loan size your upfront.

:max_bytes(150000):strip_icc()/shutterstock_431846191_mortgage_insurance-5bfc3173c9e77c005180e01a.jpg)

A Guide To Private Mortgage Insurance Pmi

Fha Loan Requirements Limits And Approval Tips Lendingtree

What Is Fha Mortgage Insurance Rocket Mortgage

Fha Loan Mortgage Insurance Termination

What Is A Mortgage Insurance Premium Mip Quicken Loans

:max_bytes(150000):strip_icc()/ufm-cd54b4e925494b25a680d315537cd85d.jpg)

What Is An Upfront Mortgage Insurance Premium Ufmip

How Much Is Fha Mortgage Insurance

Fha Loans Archives Mortgage Blog

Up Front Mortgage Insurance Premium Ufmip Changes For Fha Loans

Pros And Cons Of Fha Loans The Good And The Bad Total Mortgage

Mortgage Insurance Articles And Fha Updates Fha News And Views

:max_bytes(150000):strip_icc()/Final4236-a0715ffe24a64156951e5f2340550179.jpg)

Combined Loan To Value Cltv Ratio Definition And Formula

Fha Mortgage Insurance 2016

Update On Fha Mortgage Insurance Premiums For Washington Home Buyers

:max_bytes(150000):strip_icc()/shutterstock_532025803.mortgage.insurance.cropped-5bfc314046e0fb00265cf926.jpg)

Up Front Mortgage Insurance Ufmi Definition And Calculation

Loan Vs Mortgage Top 7 Best Differences With Infographics

Fha Loan Calculator Check Your Fha Mortgage Payment