Interest income formula

Find out the initial principal amount that is required to be invested. Operating net income is typically the figure lenders and investors will consider before making financial decisions as it shows how profitable the company is.

Net Interest Income Overview And How To Calculate It

Net Income Total Revenues Total Expenses.

. Start date end date rate Deposits in. Interest rate of annual payments x remaining balance monthly interest paid. If you have 100 and the simple interest rate is 10 for two years you will have 102100 20 as interest.

For income tax purpose. The cost to income ratio is primarily used in determining the profitability of. You can quickly determine your net income by using this simple formula.

Calculating the principal is now a cinch. Now that youve learned about net vs. Relevance and Use of Accrued Interest Formula.

You can deduct investment interest expense against any investment income -- but only if. To increase cash flows and to further increase the value of a business tax shields are used. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and.

Compound Interest Explanation. The lower the cost to income ratio the better the companys performance. The basis of accrued interest is based on accrual-based accounting.

From here a simple formula for interest would be. Using the same number above we can determine that interest will be 66767 for the first month. Gross income and net vs.

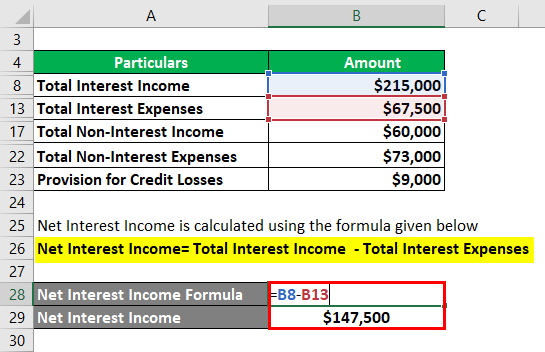

The formula is given below. Tax Shield Formula. So the yearly interest rate for the amount invested in the monthly income scheme is around 8.

Now you can plug both numbers into the net income formula. The Net Income Formula Explained. And the interest is payable in the frequency which is monthly and the rate of interest calculated is calculated based on daily.

Operating income youre probably wondering how you can easily calculate your businesss net income. A creditor has extracted the following data from the income statement of PQR and requests you to compute and explain the times interest earned ratio for him. Net income total revenue 75000 total expenses 43000 Net income 32000.

This will give you 43000. Gross profit and net income should not be used interchangeably. The cost-to-income ratio is one of the efficiency ratios used to gauge an organizations efficiency.

The effect of a tax shield can be determined using a formula. Net Income Interest Expense Taxes Operating Net Income. The tutorial explains the compound interest formula for Excel and provides examples of how to calculate the future value of the investment at annual monthly or daily compounding interest rate.

Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. This number is typically reported on the income statement under a line item. Local bank made 100000 of interest income from the outstanding loans it lent customers during the year.

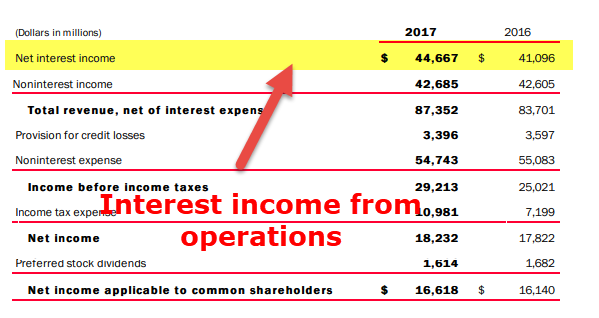

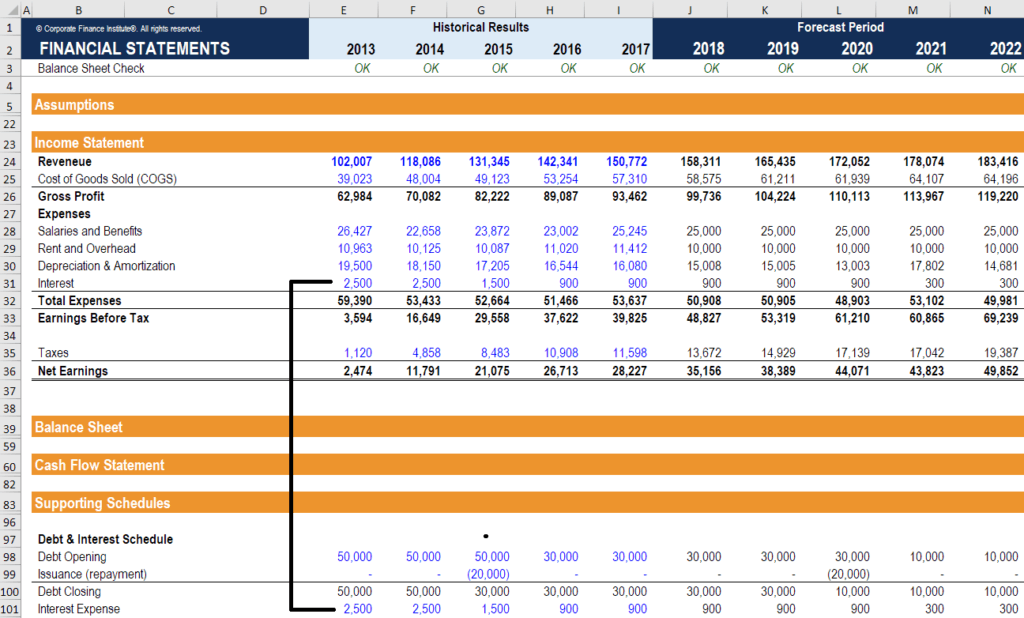

Under the single-step method the formula for income statement calculation is done by using the following steps. Next determine the non-operating items such as interest income one-time settlements etc. Income before interest and tax ie net operating income and interest expense figures are available from the income statement.

The balance on your loan is now 19971184. The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. To calculate operating income you would use the following formula.

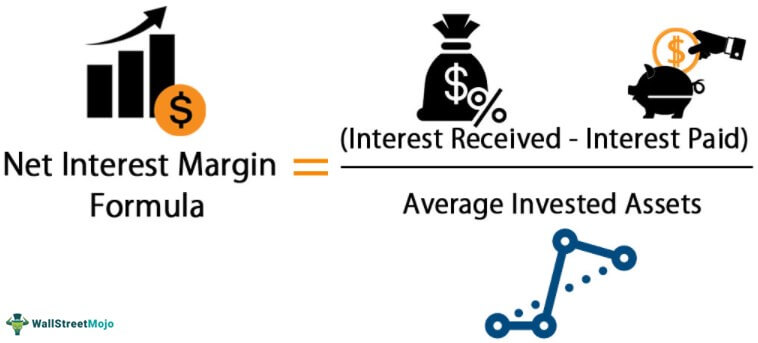

Interest expense in this context simply equals the amount of money borrowed times the stated interest rate. In the first quarter your bakery had a net income of 32000. The net interest margin formula is calculated by dividing the difference of investment income and interest expenses by the average earning assets.

To compute compound interest we need to follow the below steps. Cost to Income Ratio. In simple interest you earn interest on the same principal for the investment term and you lose out on income that you can earn on that additional amount.

It is used to compare the operating expenses of a bank vis-à-vis its income. 95483 - 66767 28816. And if financial year interest exceeds INR 50000- otherwise no tds deducted.

This reduces the tax it needs to pay by. Finally the net income calculation is done by adding the net of non-operating items non-operating income non-operating expense.

Bank Efficiency Ratio Formula Examples With Excel Template

Interest Income Definition Example How To Account

Compound Interest Formula With Calculator

Net Interest Income Nii Formula And Calculator Excel Template

Times Interest Earned Ratio Meaning Formula Calculate

Net Interest Margin Meaning Formula How To Calculate Nim

Simple Interest Formula And Examples Mathbootcamps

Times Interest Earned Ratio Formula Examples With Excel Template

Net Interest Income Financial Edge

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

Interest Income Formula And Calculator Excel Template

Net Interest Income Nii Formula And Calculator Excel Template

Interest Income Formula And Calculator Excel Template

Interest Formula Calculator Examples With Excel Template

Accrued Interest What It Is And How It S Calculated

Interest Expense How To Calculate Interest With An Example

Accrued Interest Formula Calculate Monthly Yearly Accrued Interest